What’s the Difference Between Filing Personal Taxes and Business Taxes?

Although there are some similarities between business and personal taxes – both require forms to be filled out, deadlines to be met and possible deductions and credits to be calculated – there are profound differences between the two systems.

- The forms you’re required to complete are different from personal tax forms and can vary depending on your business structure.

- Although there are progressive tax rates for businesses, similar to the varying rates for individuals, there are a diverse variety of complicating variables that may affect corporate tax rates.

- The types of business deductions or tax credits available are typically different.

- Many businesses don’t have just one tax deadline and instead have to make quarterly withholding payments.

- Although there are some similar best practices for personal and business tax planning, the strategies can vary due to the different types of credits and incentives available.

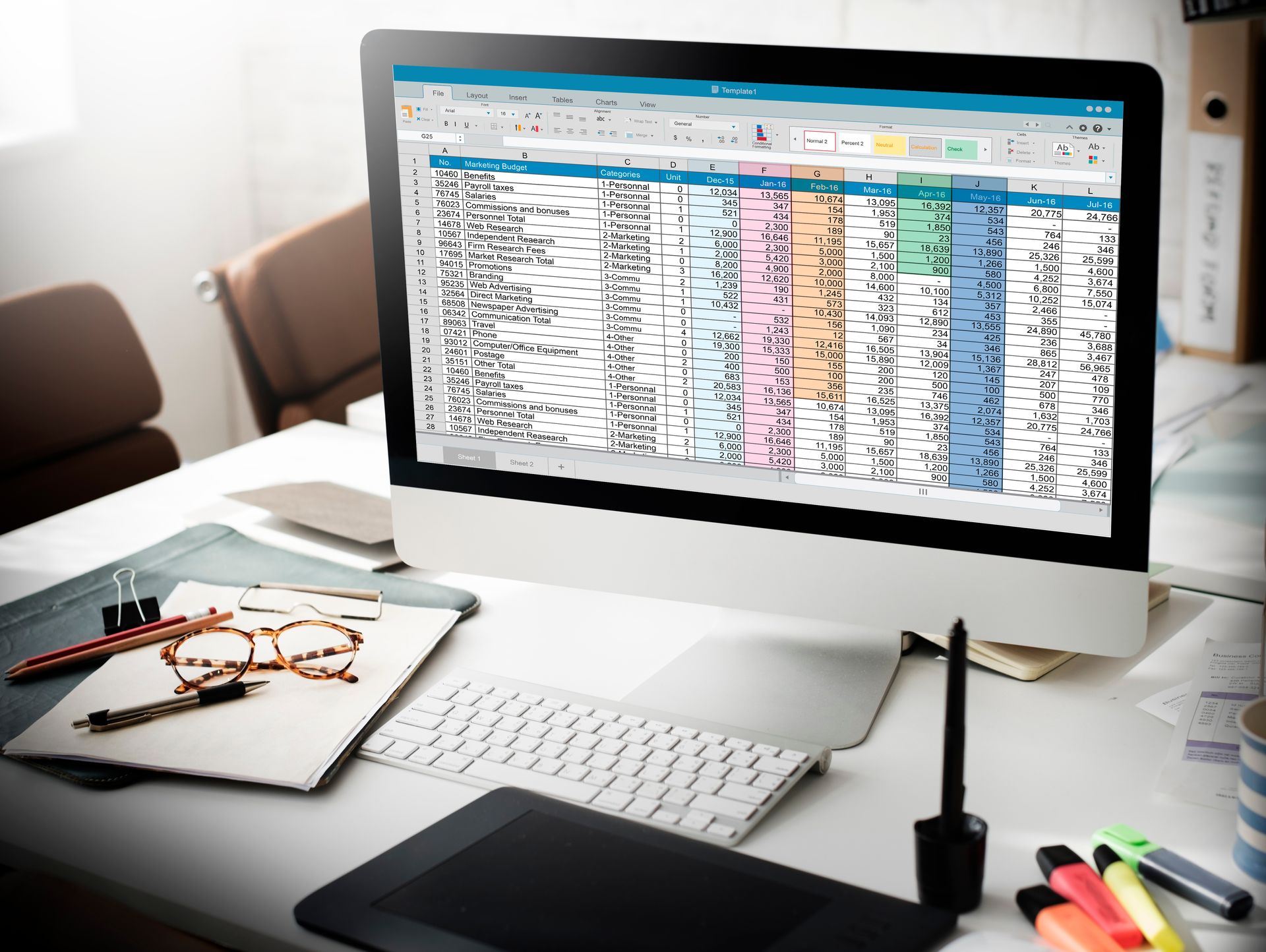

- Record-keeping and bookkeeping are far more important for businesses and are necessary for substantiating any claimed deductions or to deal with audits if they occur.

Those are just some of the generalized differences from a birds-eye view. From a process standpoint, filing business taxes can be much more complex than personal tax filing.

Characteristics of Personal Income Taxes

Individual income taxes aren’t a mystery to most people – you’re taxed at a progressive rate, from 10 to 37 percent, based on your taxable income. You can claim deductions, such as those for mortgage interest payments and charitable contributions, as well as credits, like for education spending or the Earned Income Tax Credit. Deductions or credits reduce your taxable income, potentially allowing some filers to drop into a lower tax bracket.

Your personal status – single, married filing jointly, married filing separately or head of household – affects your tax bracket calculation and deductions.

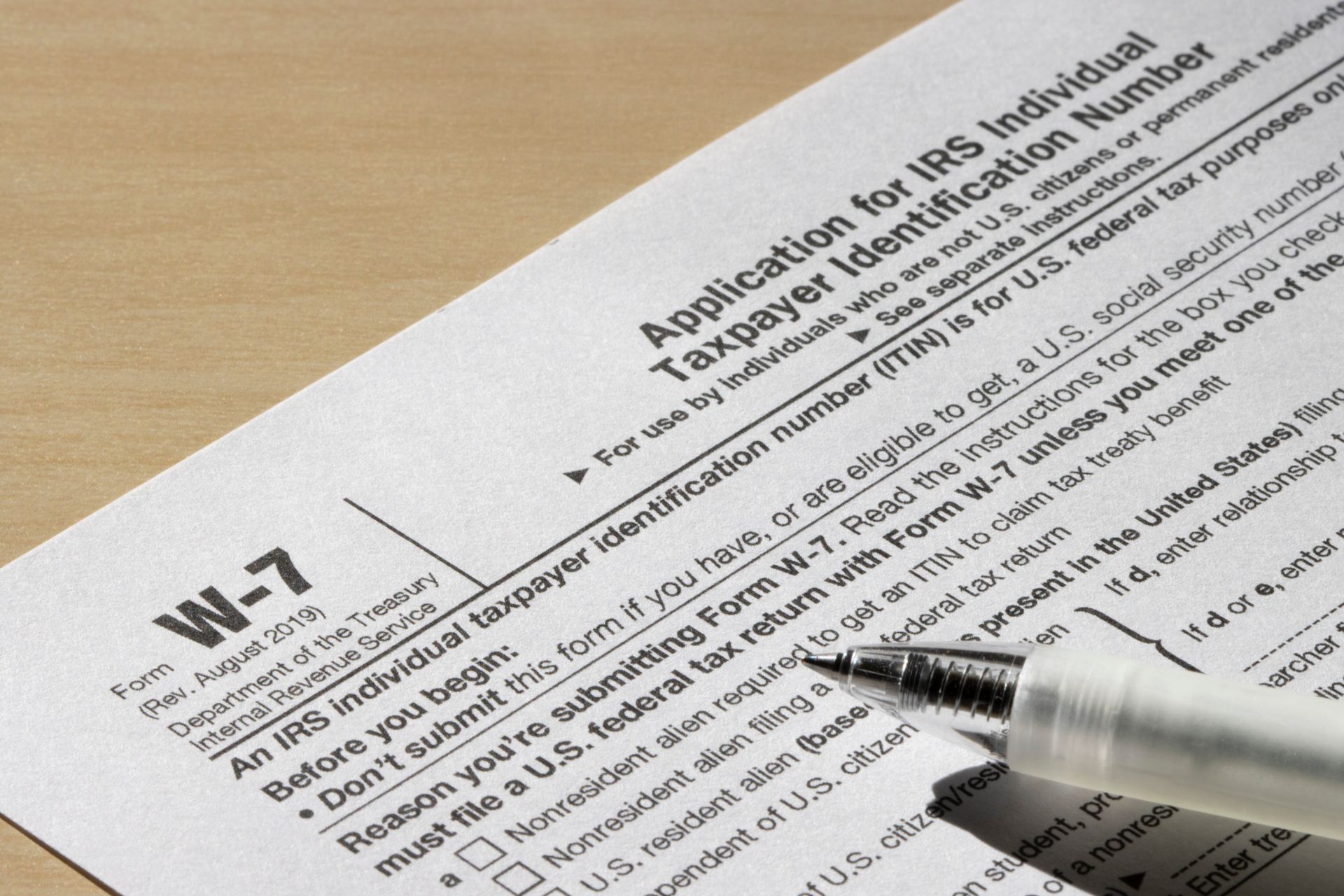

The primary tax filing form for individual filers is the IRS Form 1040.

Characteristics of Business Income Taxes

The concept of business taxes is essentially the same as income taxes – if your business makes money and is structured in a certain way, the government will want a cut of the profits. All types of for-profit business entities, from corporations and partnerships to sole proprietorships, must pay taxes in some form.

The tax structure under which the business must file is dictated by the legal structure. Corporations are subject to corporate income tax rates, whereas pass-through entities like sole proprietorships or S-corps essentially don’t have separate business taxes since the owner just claims that as income on their personal tax return.

In other words, if you’re a sole proprietor, you don’t have to file a separate business tax return because you’re reporting your business income and expenses as your own personal income and expenses. This also means you could have access to more business-related deductions and credits on your personal income tax return.

Other types of businesses, including corporations and partnerships, can also claim a variety of deductions and expenses – even for purely operational costs like rent payments, utilities, payroll and even the costs of goods sold.

There could also be credits available for certain activities that have the potential to benefit your business in the future, like research and development.

Many businesses, including people who are self-employed sole proprietors, must make estimated quarterly tax payments since there is no built-in withholding (unlike for individuals employed by businesses that withhold taxes from each paycheck).

The primary forms of businesses vary but are often Form 1120 for corporations or Form 1065 for partnerships.

Should You Hire a Professional Tax Preparer for Your Individual or Business Income Taxes in Phoenix?

Whether you need professional tax preparation for your personal income taxes depends on the complexity of your situation. If you’re claiming credits and deductions or have a drastic change in reported income that could raise flags at the IRS, it may be in your best interest to work with a professional tax preparer to ensure you strictly follow all the laws and codes. If you’re in a low to medium tax bracket and take the standard deduction, you will likely be fine just using a low-cost software solution.

Business taxes are another matter. Even small businesses often benefit from the help of a professional tax preparer who can help you identify all available deductions and credits and make proper use of them to ensure you don’t run afoul of any reporting rules or laws governing their use.

The team at H&H Accounting Services excels at helping individuals and businesses file their taxes to maximize savings. Don’t leave money on the table by paying the government more than you should. Our team will help ensure you can reinvest as much tax savings as possible back into your business. Call us at (480) 561-5805 for a free one-hour consultation.