Understanding Risk Management and Forecasting for Your Small Business

Risk management and forecasting are both valuable exercises for small businesses. Risk forecasting can help you predict and prepare for risks, both those that are obvious and likely and the unlikely or unforeseen. Forecasting is often necessary for securing financing and to ensure your business is well situated for continued prosperity.

Risk Management

Everything in life has some degree of risk. Getting in your car and driving to work carries risk. Going out for a jog or a hike has risk. Every business, no matter its size, faces some risks.

Risks of all kinds can be mitigated. You can wear a seat belt when you drive and adhere to defense driving techniques to reduce your accident risks while driving. You can stretch before a run to reduce your injury risk.

Your business can also predict and plan for potential risks.

There are three broad steps that go into risk management for a business:

· Identifying risks

· Predicting the impact of those risks

· Planning for those risks

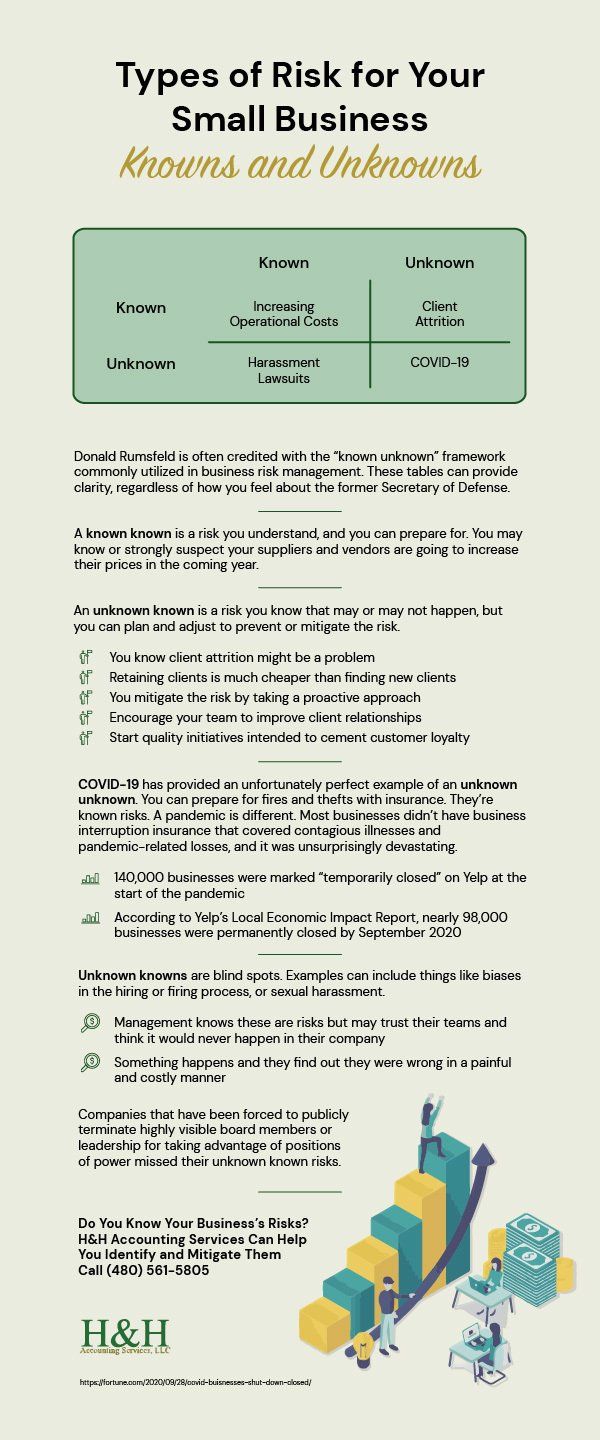

Business risks often fall into one of two categories: internal risks and external risks. Internal risks are problems that can arise from within your business. You have the most control over preventing internal risks. External risks come from outside of your business, so you may not have as much preventative control over external risks.

Internal risks can include something like losing a key employee, having equipment breakdowns or even employee malfeasance like theft.

External risks can be something like a pandemic (COVID-19) or a natural disaster. The economy can slow down, a new competitor might open in your area or the government may impose new regulations on your industry.

It’s harder to prevent external risks, but in some cases you may be able to plan for them or at least give your business breathing room to adapt to them.

If you’re making a formal risk management plan you should consider listing out these risks and then ranking them by probability. The most likely risks are the ones for which you should put serious thought into creating a plan to address.

It may turn out the expense of mitigating some risks costs more than the risk itself. Consider grocery stores and power outages. Many grocery stores don’t have backup generators because they are expensive and power outages are few and far between. Grocery stores have established procedures for the risk of power outages, namely they keep all the freezer doors closed. If a power outage goes on for too long and food thaws out, they will just have to eat the loss.

A store in Phoenix might operate for decades without ever experiencing a long-term power outage that leads to inventory loss, making the investment in multiple generators for a low probability risk an inefficient use of funds.

A store in an area where power outages are frequent may make a different calculation and decide the extra cost of a generator is less than the frequent replacement cost of inventory lost to spoilage.

A business that relies on fleet vehicles can minimize the risk of breakdowns by keeping up with preventative maintenance. Regular maintenance extends the life of their vehicle investments and reduces the risk that a vehicle will suffer a catastrophic breakdown and require costly replacement.

Some industries have a real risk of having top tier talent poached by competitors. Those businesses can put non-compete clauses in their employment contracts and protect themselves from employees moving to a competitor or starting their own company and taking their book of business with them. If a worker were to do that, the employer could sue, which minimizes that risk. Employers can also offer competitive compensation to ensure they’re attracting and keeping top talent.

Businesses can also invest in certain types of insurance, like business interruption coverage, to ensure they are compensated if a known risk occurs, and they lose revenue or inventory as a result.

Financial and Sales Forecasting

A business consultant or commercial accountant may be able to help your business develop pro forma financial statements, or essentially a set of projected future financial statements. They can be developed based on growth expectations using past years performance, expected growth and industry health.

Knowing where you want or expect to be in the quarters and years ahead can help you adjust your business as performance meets, falls short of or exceeds those goals.

Forecasting can also help with risk management by spotting trouble before it becomes a potentially fatal problem for your business. Some businesses seeking significant financing may even be required to develop three- and five-year pro forma statements for lenders or equity investors. If you are shopping your business to venture capitalist or angel investors, chances are they will expect to see pro forma financial statements.

These statements often include things like:

· Sales growth projections

· Your product schedules and projected increases in production

· Your projected operating expenses

· Projected revenue and profit, if all goes according to plan

The key to developing pro forma forecasts is usually sales or service projections. If your expenses are linear based on fixed or variable production costs, it’s just a matter of calculating what your expenses would be for that level of production. Then you can calculate revenue and profit based on projected sales and operating cost calculations.

Get Help with Forecasting and Risk Management

H&H Accounting Services in Phoenix is proud to help small and medium-sized businesses in the Valley develop plans to mitigate risks and develop reliable financial forecasting reports. Our experienced

business accountants and

business consultants would be happy to sit down for a free initial consultation to discuss your business and how you can grow and safeguard it. Call us at (480) 561-5805 to

get started